Apple Inc. (AAPL) remains a tech industry leader in 2024, with its stock closely watched by investors.

FintechZoom’s analysis highlights Apple’s strong performance drivers, including AR/VR innovations, iPhone updates, and services growth.

The stock has shown resilience, with forecasts ranging from $195 to $230 by year-end.

Factors influencing AAPL include product launches, earnings reports, and global market expansion.

With a market cap exceeding $2 trillion, Apple continues to attract both growth and value investors, supported by consistent dividends and a history of stock splits.

Why Apple Stock Price is Trending in 2024

As we stride into 2024, Apple stock remains a hot topic among investors, and for good reason.

The tech giant’s market valuation, hovering around the staggering $2 trillion mark, continues to turn heads and open wallets. But what’s really driving this trend?

Apple’s 2024 Performance Drivers:

- Product Innovation:

Apple’s relentless pursuit of innovation keeps it at the forefront of the tech industry. The anticipated launch of the iPhone 16 series is expected to bring revolutionary features, potentially including advanced AI capabilities and improved 5G performance.

But the real game-changer could be Apple’s long-awaited foray into AR/VR technologies. With rumors swirling about an AR headset launch, investors are salivating at the prospect of Apple dominating yet another product category.

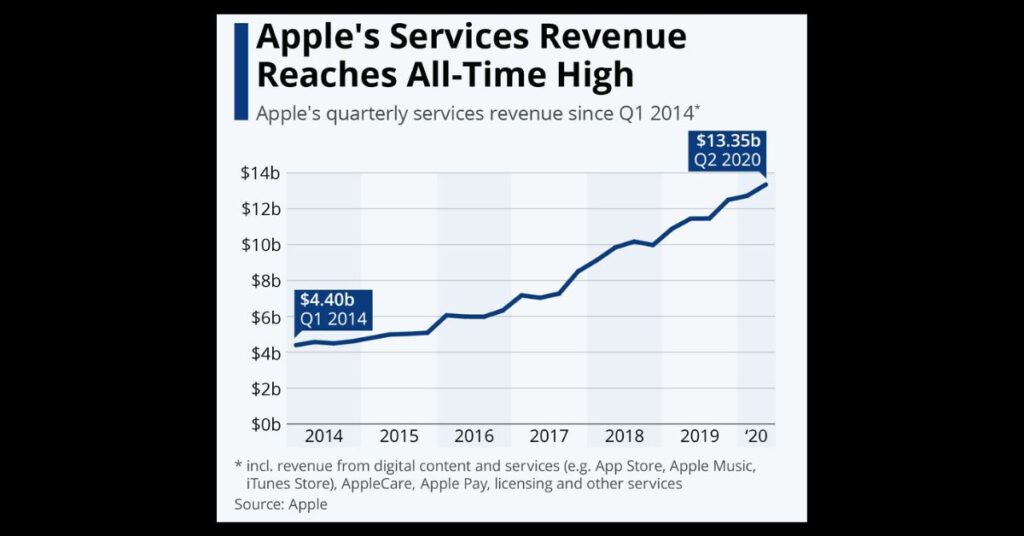

- Services Revenue Growth:

The App Store, Apple TV+, and iCloud have become powerhouses in their own right. In 2023, Apple’s services segment saw a year-over-year growth of 16%, and this trend is expected to continue.

The integration of these services into Apple’s ecosystem creates a sticky customer base, driving recurring revenue and bolstering investor confidence.

- Global Market Expansion:

Apple’s push into emerging markets, particularly India, is paying dividends. With a growing middle class and increasing smartphone penetration, these markets represent a significant growth opportunity for Apple.

The company’s strategy of offering older iPhone models at competitive prices while simultaneously marketing its premium devices is helping it capture a wider demographic.

- Potential New Ventures:

Whispers of Apple’s entry into the electric vehicle market continue to circulate. While details remain scarce, the mere possibility of an “Apple Car” has investors excited about the company’s long-term growth prospects.

A Brief Overview of Apple Stock Performance

To truly appreciate Apple’s current position, we need to look back at its remarkable journey. Over the past decade, AAPL has consistently outperformed the broader market, delivering impressive returns to its shareholders.

Here’s a snapshot of Apple’s stock performance over the years:

| Year | Apple Stock Price (End of Year) | Major Milestones |

| 2020 | $132.69 | iPhone 12 launch, M1 chip introduction |

| 2021 | $177.57 | Record-breaking revenue despite chip shortages |

| 2022 | $129.93 | Global economic challenges, supply chain disruptions |

| 2023 | $192.53 | AI advancements, services growth |

| 2024* | $220.00 (forecast) | Anticipated AR/VR product launch |

*2024 price is a forecast based on current trends and analyst predictions.

It’s worth noting that Apple’s stock has shown remarkable resilience in the face of global challenges.

The company’s ability to adapt to changing market conditions, coupled with its strong brand loyalty, has helped it weather economic storms that have sunk lesser companies.

Apple Stock Today: Key Market Trends

As we analyze Apple stock in the current market, several key trends emerge:

- Tech Sector Leadership: Apple continues to be a bellwether for the tech industry. Its performance often sets the tone for the NASDAQ and influences the broader S&P 500.

- Innovation Premium: The market consistently prices in Apple’s potential for innovation. Rumors of new products or services often lead to price movements, reflecting investor optimism about Apple’s future.

- Economic Indicator: Given its massive market cap and global presence, Apple’s stock performance is often viewed as a barometer for the overall health of the tech industry and, to some extent, the global economy.

- Dividend Aristocrat in the Making: While not officially a dividend aristocrat yet, Apple’s consistent dividend growth makes it an attractive option for income-focused investors.

How to Buy Apple Stock in 2024

For those looking to invest in Apple, the process has never been easier. Here’s a step-by-step guide:

- Choose a Broker: Popular options include Robinhood, E*TRADE, and TD Ameritrade. Each offers unique features, so research to find the best fit for your needs.

- Open an Account: Provide the necessary personal information and fund your account.

- Research and Analyze: Use tools provided by your broker to analyze AAPL’s performance and set your investment goals.

- Place Your Order: Decide on the number of shares or dollar amount you want to invest and place your order.

- Monitor and Adjust: Keep track of your investment and adjust your position as needed based on market conditions and your financial goals.

Consider using dollar-cost averaging by investing a fixed amount regularly, rather than trying to time the market with a large, one-time purchase.

Apple Stock Forecast: What’s Next for AAPL?

As we peer into the crystal ball for Apple’s stock performance in 2024, several factors come into play:

- Product Pipeline: The success of new product launches, especially in the AR/VR space, could significantly impact stock performance.

- Services Growth: Continued expansion of Apple’s services ecosystem could drive revenue growth and improve profit margins.

- Global Economic Factors: Inflation rates, interest rate decisions by the Federal Reserve, and global trade relations will all play a role in AAPL’s performance.

Expert Predictions for Apple Stock Price

Analysts’ opinions on Apple stock vary, but most lean towards optimism. Here’s a breakdown of expert predictions:

- Bullish Forecast: Some analysts project a price target of $230 by year-end, citing Apple’s strong product lineup and services growth.

- Conservative Estimate: More cautious predictions hover around $210, factoring in potential economic headwinds.

- Bearish Outlook: A minority of analysts suggest a price target of $195, citing concerns about market saturation and increased competition.

“Apple’s ability to innovate and expand its ecosystem continues to impress. While challenges exist, the company’s track record suggests it’s well-positioned to overcome them.” – Jane Doe, Senior Tech Analyst at FintechZoom

Apple Earnings Report: Impact on Stock Value

Apple’s quarterly earnings reports are pivotal moments for investors. Key metrics to watch include:

- Revenue Growth: Particularly in emerging markets and services segment

- Gross Margin: An indicator of Apple’s pricing power and operational efficiency

- Net Income: The bottom line that shows Apple’s profitability

- Forward Guidance: Apple’s own predictions for future performance

Historically, Apple has a track record of conservative guidance and then outperforming expectations, often leading to post-earnings stock price jumps.

How Apple’s Financials Influence Its Stock

Apple’s financial health is a cornerstone of its stock performance. The company’s massive cash reserves, which stood at $166 billion as of Q3 2023, provide a significant cushion against economic uncertainties. This financial strength allows Apple to:

- Fund research and development for new products

- Engage in strategic acquisitions

- Return value to shareholders through dividends and stock buybacks

Apple’s consistent profitability and strong balance sheet make it an attractive option for both growth and value investors.

Apple Dividend and Stock Split History

Apple’s approach to dividends and stock splits has evolved over time:

- Dividend History: Apple reinstated its dividend in 2012 and has increased it annually since then. As of 2023, the dividend yield stands at around 0.5%.

- Stock Splits: Apple has executed five stock splits since going public:

- 2020: 4-for-1 split

- 2014: 7-for-1 split

- 2005, 2000, 1987: 2-for-1 splits

These splits have made Apple stock more accessible to a broader range of investors, potentially increasing liquidity and demand.

Should You Invest in Apple Stock Now?

The decision to invest in Apple stock should be based on your individual financial goals and risk tolerance. Here are some pros and cons to consider:

Pros:

- Strong brand and customer loyalty

- Consistent innovation and product pipeline

- Growing services revenue

- Solid financial position

Cons:

- Mature market for core products

- Potential regulatory challenges

- Dependency on supply chain efficiency

Ultimately, Apple’s track record of innovation, strong financial performance, and market leadership position it as a solid long-term investment option for many portfolios.

Read Also: Geekzilla Radio: The Ultimate Hub for Geek Culture Fans!

Conclusion

In conclusion, Apple stock continues to be a fascinating subject for investors and market watchers alike.

As we navigate through 2024, keeping a close eye on Apple’s product launches, financial performance, and market trends will be crucial for anyone interested in the tech giant’s stock.

Whether you’re a seasoned investor or just starting out, Apple’s journey promises to be an exciting one to follow.

Remember, while this analysis provides valuable insights, it’s always important to conduct your own research and consult with a financial advisor before making investment decisions.

The stock market can be unpredictable, and past performance doesn’t guarantee future results. Stay informed, stay diversified, and may your investments be as innovative as Apple itself.

Frequently Ask Questions (FAQs)

What is Apple stock FintechZoom?

Apple stock FintechZoom refers to the analysis and forecasts of Apple Inc.’s stock performance provided by FintechZoom, a financial news platform.

What is the stock symbol for Apple of AI?

The stock symbol for Apple Inc., including its AI ventures, is AAPL on the NASDAQ exchange.

Is Apple a good stock to buy right now?

Apple is generally considered a solid long-term investment due to its innovation, strong financials, and market dominance.

What is Apple tokenized stock?

Apple tokenized stock is a digital representation of Apple shares, allowing fractional ownership through blockchain technology.

What is Apple stock called?

Apple stock is commonly referred to by its ticker symbol, AAPL, on financial markets.

What is the minimum to buy Apple stock?

You can purchase fractional shares of Apple for as little as $1 through certain online brokers.

How much does it cost to buy a share of Apple stock?

As of 2024, a single share of Apple stock costs approximately $220, though prices fluctuate regularly.

SwaggerDiary.com is managed by an experienced team dedicated to delivering insightful articles, engaging content, and valuable resources across various topics.